Unemployment Rate Hits Record-Low; Wage Growth Finally Starting to Rise

Canadian employment rose by a respectable 40,000 jobs in May, led by full-time jobs, after having a slower gain of 15,000 net new jobs in April.

Hours worked failed to bounce back in May and continue to disappoint, falling by 0.3%, as employee absences remain higher than before the pandemic. Hours fell by 1.9% in April, again due to increased work absences due to illness, which affected 9% of employees.

The unemployment rate continued to edge down, reaching a new monthly record low of 5.1%. The Bank of Canada’s composite “Labour Market Indicator” also recorded its best performance (at 5.5% in 2022 Q1) since the series began in 2003.

Employment in May was led by full-time positions (+135k, 0.9%), while part-time employment was down 96k (-2.6%). Services sectors (+81k) were a source of broad-based strength, while goods sectors were down 41k — mostly related to weakness in manufacturing (-43k). By gender, employment was up for women (+58k), but down for men (-18k).

Labour markets remain very tight. We’ve been waiting a while for stronger signs of wage pressures. In today’s report, average hourly wages accelerated to 3.9% year-on-year, up from only 3.3% in April. Wage growth was strongest for non-unionized (5.1%) and permanent (4.5%) employees. Of course, wages are still playing catch-up, and remain well below the current rate of inflation (6.8%).

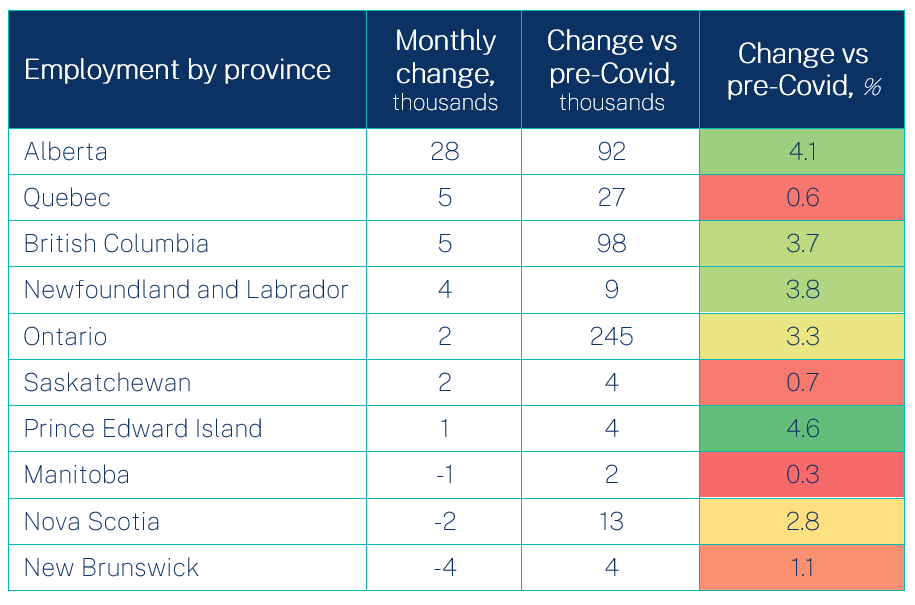

Provincial employment recorded statistical increases in Newfoundland and Labrador, Prince Edward Island, and Alberta. It declined in New Brunswick and was little changed in all other provinces.

In May, 19% of workers did so from home.